Rent Lease Journal Entries, Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Rent lease journal entries Indeed recently is being hunted by consumers around us, maybe one of you personally. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the title of this post I will talk about about Rent Lease Journal Entries.

- Accounting For Leases The Marquee Group

- Prepaid Rent Accounting Entry Double Entry Bookkeeping

- Solved P21a 1 Lessee Entries Finance Lease Lo 2 4 Chegg Com

- Lease Accounting For Broker Dealers The Ledger Mazars Usa The Ledger Mazars Usa

- Finance Lease Accounting Journal Entries Pdf Financeviewer

- Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Find, Read, And Discover Rent Lease Journal Entries, Such Us:

- Accounting Entries For Operating Leases With Case Study Example Learn Accounting Online

- Leasing Hire Purchase Factoring Forfeiting And Venture Capital

- Example How To Adopt Ifrs 16 Leases Ifrsbox Making Ifrs Easy

- Accounting For Leases The Marquee Group

- Ifrs 16 Examples Summary How To Transition From Ias 17

If you re looking for Apartments For Rent Near King Of Prussia you've arrived at the right place. We ve got 104 images about apartments for rent near king of prussia including pictures, photos, photographs, backgrounds, and more. In such webpage, we additionally have variety of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, transparent, etc.

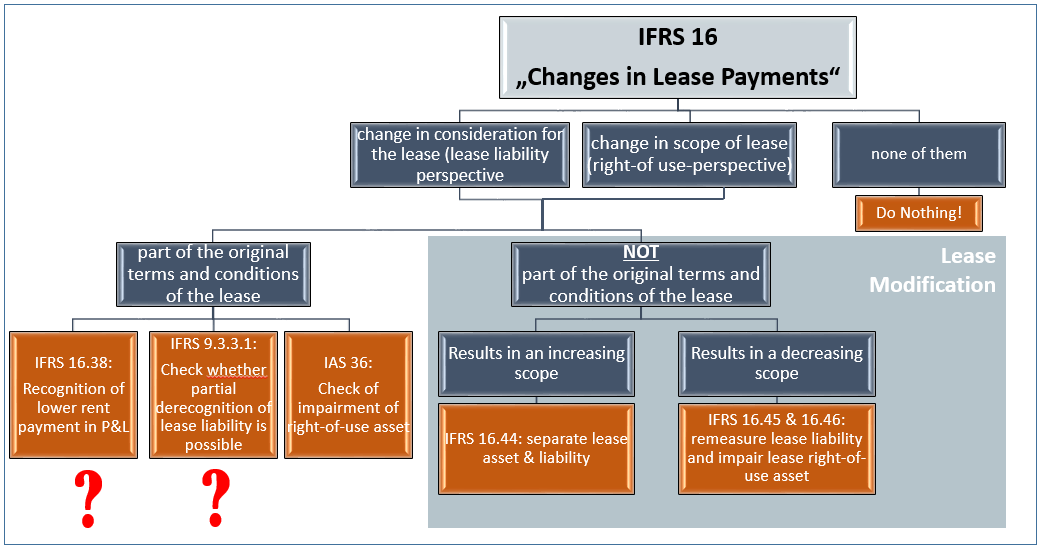

Coronavirus Adjustments To Rental Payments And Ifrs 16 Valuesque Apartments For Rent Near King Of Prussia

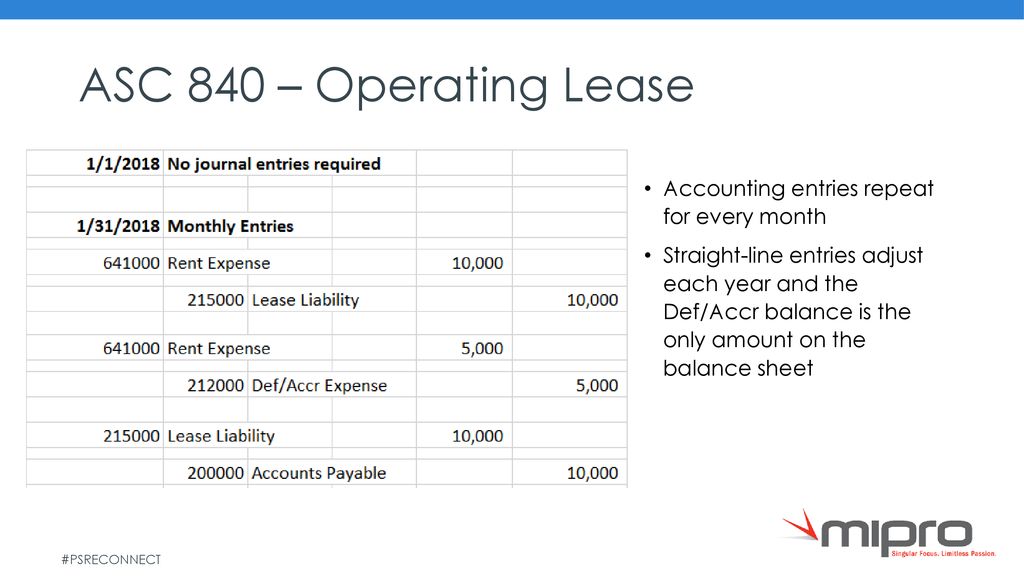

The lessor would debit rent receivable for 833 and credit rent revenue for 833.

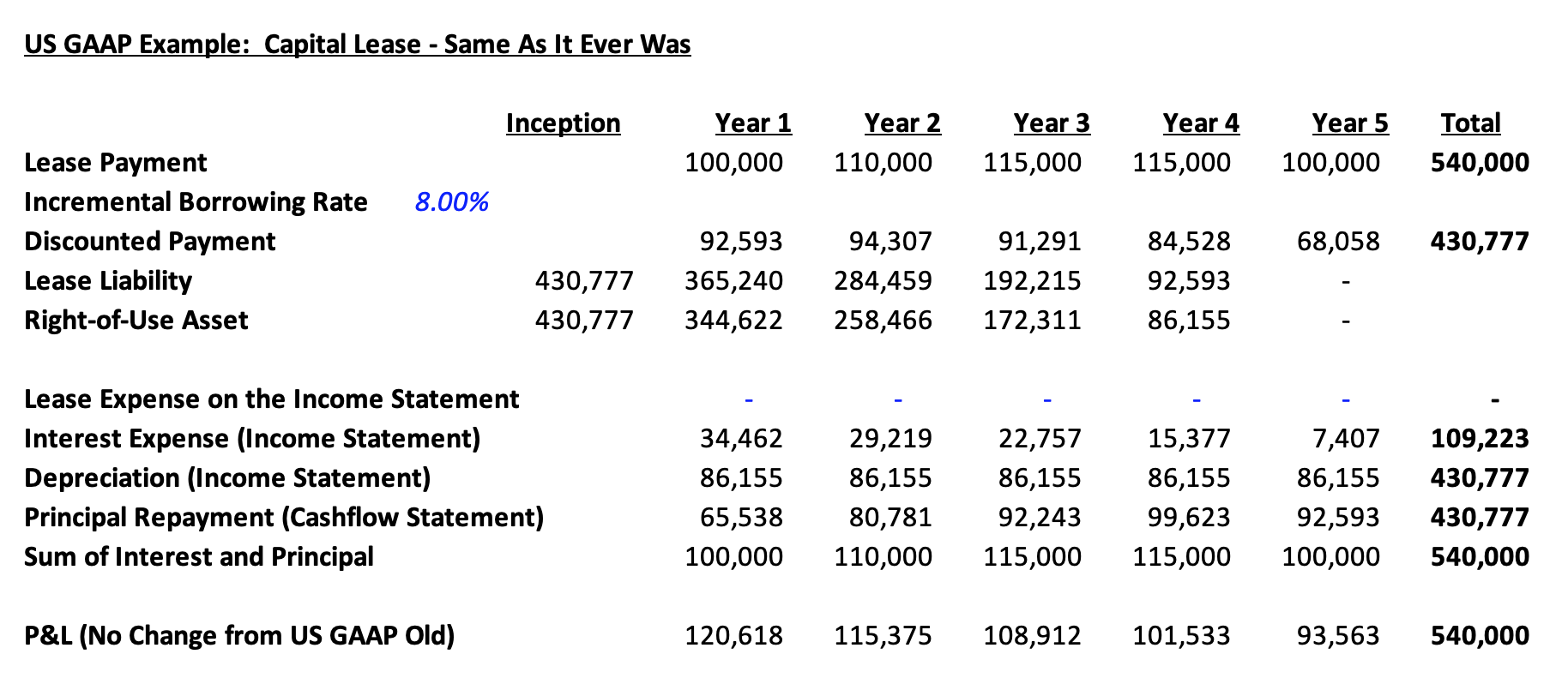

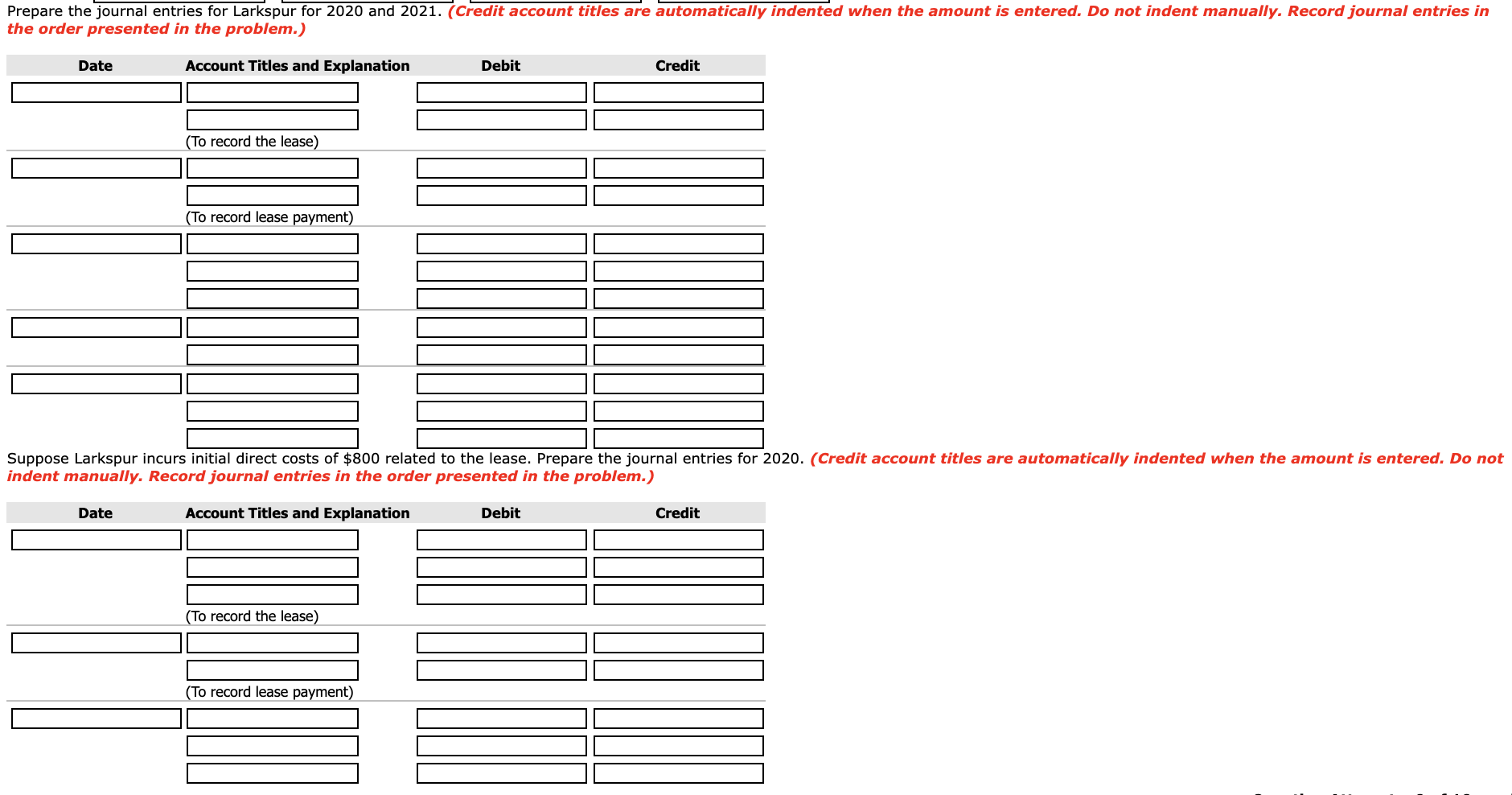

Apartments for rent near king of prussia. Now let us have a look at the journal entry for recording the operating lease rental transaction for each month example 2. In this example it is the liability of 10604260 plus the deferred rent balance as of december 2021 plus the unamortized incentive. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases.

The lease income is recognized on a basis reflecting the use of the asset. Now if you paid say 3 months rent in advance then things would be handled differently. In line with the above requirements the lease payments will be recognised on a straight line basis over the lease term and the rent free period will be spread over the lease term as a reduction to the lease expense.

Let us take the example of a company named abc ltd that has recently entered into a lease agreement with a company named xyz ltd for some specialized it equipment for a 2 year lease that involves payment of 20000 at the end of 1 st year and 24000 at the. Journal entries in case of an operating lease if a lessor determines a contract to contain only an operating lease it is not required to recognize any asset or liability. Hi thanks for the valuable information.

In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Steps to capital lease accounting. I am paying 100000 per month.

In the example above the first month sees no cash changing hands but revenues and expenses must still be recognized by the two parties through entries in the general journal. The present value of the lease rental of such a lease is greater than 90 of the asset leaseds fair value at the time of lease. Record the journal entry to recognize the first months payment.

Calculate the right of use asset with journal entry per fasbs lease accounting standard the rou asset is the liability calculated in step 5 above adjusted by deferred rent and lease incentives. Your journal entries guide to lease incentive accounting. Assuming you have not prepaid any rent for the next x amount of monthsand are just paying as you go it would be a debit to rent expense and a credit to cash.

At the end of each period the lessor records a journal entry debiting cash and crediting lease revenue. No journal entry is made to record the initiation of the lease. Suppose i have take a building on rent for the period of 10 years.

The lessor treats the operating lease as property rental. Now what is journal entry for this payment.

More From Apartments For Rent Near King Of Prussia

- 1 Bedroom Apartment Downtown Toronto

- 1 Bedroom Apartment Charlotte Nc

- Apartment Lease Laws In Texas

- My Apartment Has Mold

- 1 Bedroom Apartment Victoria

Incoming Search Terms:

- Doc Royalty Accounts Gamuchirai Makore Academia Edu 1 Bedroom Apartment Victoria,

- Lease Accounting Calculations And Changes Netsuite 1 Bedroom Apartment Victoria,

- 1 1 Bedroom Apartment Victoria,

- Rent Abatement Rent Free Period Accounting For Us Gaap 1 Bedroom Apartment Victoria,

- Topic 1 Accounting For Leases 1 Bedroom Apartment Victoria,

- Deferred Rent Accounting Tax Treatment For Asc 842 840 1 Bedroom Apartment Victoria,